unemployment income tax refund calculator

When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

2022 Tax Return How To Factor In Your Child Tax Credit And Covid Costs Npr

To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4.

. Your household income location filing status and number of personal. You reported unemployment benefits as income on your 2020 tax return. So doing a little calculation gives us the following.

This means they dont have to pay tax on some of it. State Income Tax Range. Simply select your tax filing status and enter a few other details to estimate your total taxes.

You should receive a 1099-G reporting the unemployment. This way you can report. Under the new law taxpayers who earned less than 150000 in modified adjusted gross income can exclude some unemployment compensation from their income.

Work out your base period for calculating unemployment. But in March the American Rescue Plan waived taxes on the first 10200 in unemployment income or 20400 for a. Use this 2021 Tax Calculator to estimate your 2021 Taxes.

This threshold applies to all filing statuses and it doesnt double to. And is based on the tax brackets of 2021. In case you got any Tax Questions.

58 on taxable income less than 22450 for single. Up to 10 cash back TaxSlayer is here for you. Filing with us is as easy as using this calculator well do the hard work.

This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployement Income. Heres what you need to know. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000. People who are married filing jointly can exclude up to 20400 up to 10200 for each spouse who received unemployment compensation. Unemployment compensation is taxable income which needs to be reported by filing an income tax return.

Were here for more than calculating your estimated tax refund. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. 10200 x 022 2244.

State Taxes on Unemployment Benefits. If youre claiming the Child Tax Credit or Recovery Rebate Credit on your 2021 taxes be sure to have your IRS letter for each when you file. Another way is to check your tax transcript if you have an online account with the IRS.

The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable income. Individuals should receive a Form 1099-G showing. The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive.

On March 11 President Joe Biden signed his 19 trillion American Rescue Plan into law which includes a tax break on up to 10200 of unemployment benefits earned in. To calculate your weekly benefits amount you should. 46385 plus 35 of the amount over 209400.

This Estimator is integrated with a W-4 Form Tax withholding feature. Moving on to another example weve a person and they are single. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Unemployment benefits are fully taxable in Maine. The law waives federal income taxes on up to 10200 in unemployment insurance benefits for people who earn under 150000 a year potentially saving workers thousands of. Take a look at the base period where you received the highest.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. This is the refund amount they should receive. It is mainly intended for residents of the US.

Which bracket you land in depends on. You did not get the unemployment exclusion on the 2020 tax return that you filed. This handy online tax refund.

Generally unemployment compensation is taxable. This is available under View Tax Records then click the Get Transcript button and. 156355 plus 37 of the amount over 523600.

Free Tax Calculator Estimate Your Refund For Free Free 1040 Tax Return Com Inc

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Irs Use These Calculators To Estimate Your Tax Refund Fingerlakes1 Com

Income Tax Calculator 2021 2022 Estimate Return Refund

Tax Calculator Estimate Your Taxes And Refund For Free

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

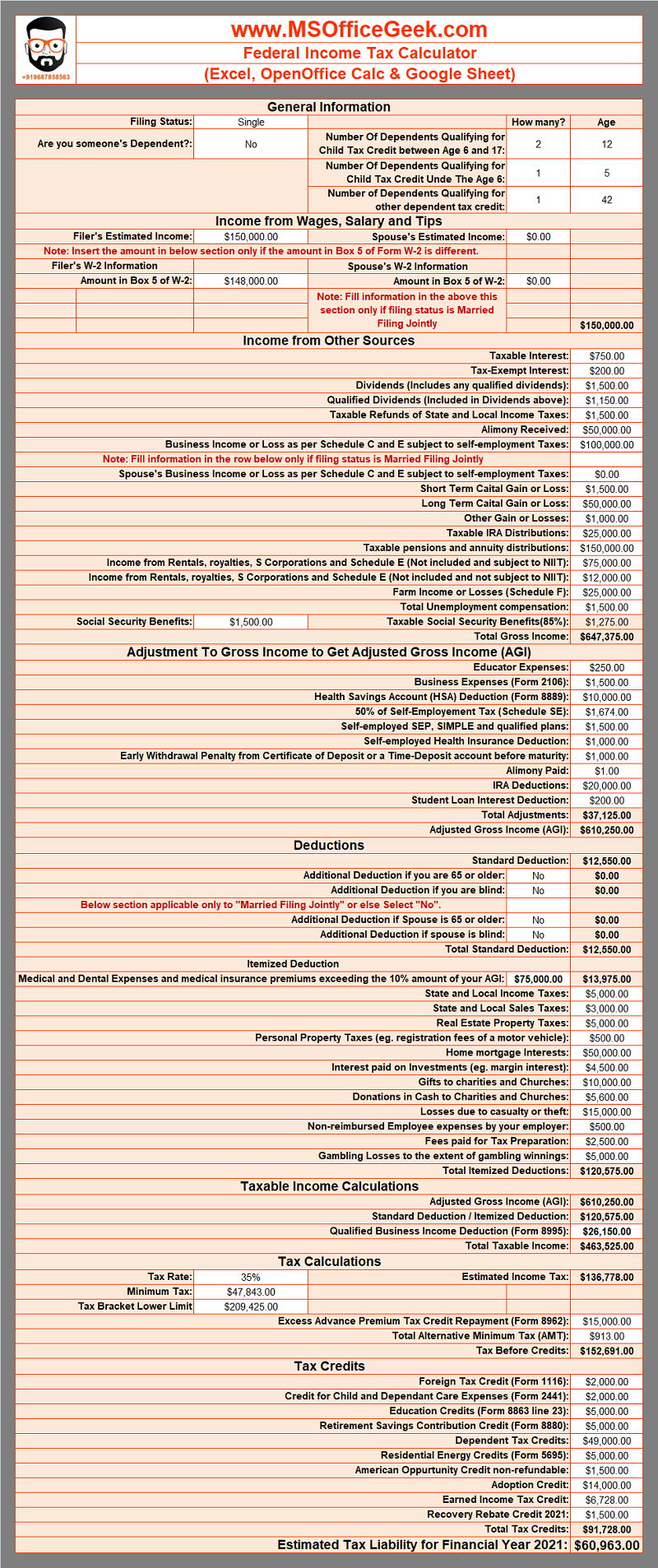

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

What Are Marriage Penalties And Bonuses Tax Policy Center

Tax Calculator Estimate Your Taxes And Refund For Free

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Household Employment Taxes Calculator Faqs Internal Revenue Code Simplified

Learn More About The Massachusetts State Tax Rate H R Block

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor